If we relax the standard assumptions of the Heckscher-Ohlin model it becomes much more difficult to distinguish empirically a multiple from a single cone equilibrium. Indeed, as indicated in figure 6, we are left with three types of tests: 1. PRODUCT MIX: If all regions produce the same group of sectors, the US is characterized by a single cone equilibrium.4 This implication is easy to verify but not very satisfying because the absence of production…

In the figure, the production of Apparel and Textiles requires only physical capital and labor, while the manufacture of Machinery requires capital, labor and human capital (H). Note as well that approaching a corner of the endowment simplex along a ray emanating from that corner represents an increase in the use (for an industry input vector) or abundance (for an endowment vector) of that factor, holding the concentration of other factors constant. Thus, Textiles use…

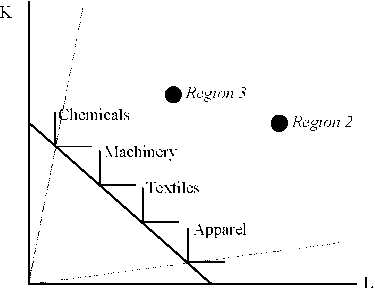

2.1. What if There Are More Sectors than Factors? Specialization of output across regions may not be indicative of a multiple cone equilibrium if prices are such that the number of sectors a region can produce profitably exceeds the number of factor inputs. This case is illustrated in figure 3, which exhibits a single cone of diversification anchored by four rather than two sectors. Because prices render the choice of product mix arbitrary, regions 2…

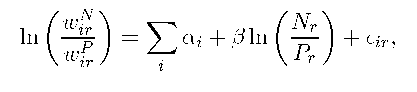

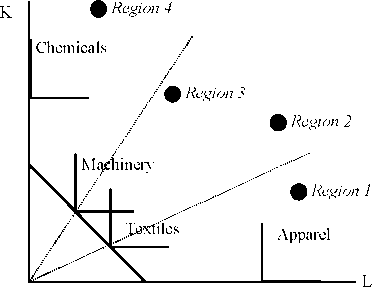

2. Single versus Multiple Cone Heckscher-Ohlin Equilibria The easiest way to build intuition for single versus multiple cone equilibria is to assume there are just two factors of production and that the world is even in the sense that regions produce just two goods at every stage of their economic development. Such a world is captured by the Lerner (1952) diagram displayed in figure 1. This figure contains unit value isoquants for four sectors, Apparel,…

Hanson and Slaughter (1999), on the other hand, find that US state factor supply changes are largely absorbed by changes in production technique that are common across states, an outcome they argue is consistent with productivity-adjusted factor price equality. In this paper we suggest that regional variation in relative factor prices is an important, unexplored component of how the US adjusts to both changes in factor supplies and the pressures of international trade.

The implications of multiple relative factor price regions extend into the industrial organization and productivity literatures as well. If regions in the US face substantially different factor prices, then many estimates of industry production functions that assume common factor prices are misspecified. This is likely to feed into calculations of productivity and markups at both the plant and industry levels.

While the concept of multiple factor price cones is usually applied across countries, it is substantially more controversial when considering regions within a relatively flexible economy such as the US. It is easy to imagine that the relative similarity of endowments, regulations and markets combined with the mobility of capital, technology, and even labor within the US would make it likely that relative price differences are at best transitory. In that scenario, the regions of…

ABSTRACT Do New York and Nashville face the same pressures from increased trade? This paper considers the role of international trade in shaping the product mix and relative wages for regions within the US. Using the predictions from a Heckscher-Ohlin trade model, we ask whether all the regions in the US face the same relative factor prices. Using the production side of the HO model, we derive a general test of relative factor price equality…