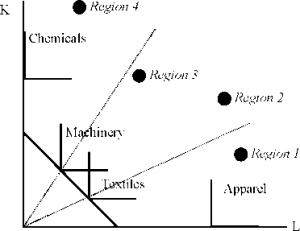

The easiest way to build intuition for single versus multiple cone equilibria is to assume there are just two factors of production and that the world is even in the sense that regions produce just two goods at every stage of their economic development. Such a world is captured by the Lerner (1952) diagram displayed in figure 1. This figure contains unit value isoquants for four sectors, Apparel, Textiles, Machinery and Chemicals, in a world with two factors, capital (K) and labor (L). Chemicals is the most capital intensive sector while Apparel is the most labor intensive sector. To keep things simple, all sectors are assumed to have Leontief technology.

Under standard Heckscher-Ohlin assumptions (Dixit and Norman 1980), the four sectors delineate three cones of diversification, the word cone referring to the set of endowment vectors that all select the same mix of products. Because production of a good outside of the cone in which a region resides results in negative profit, GDP-maximizing regions produce only the two goods anchoring their cones. In this respect, each of the three cones in figure 1 represents a standard, two good – two factor single cone equilibrium: if all US regions were located in the middle cone, for example, only Machinery and Textiles would be produced by the United States, with each region’s ratio of the two outputs depending upon their relative capital abundance. As drawn, regions 1 and 4 each have a distinct product mix, with capital abundant region 4 producing relatively capital intensive Machinery and Chemicals and labor abundant region 1 manufacturing relatively labor intensive Apparel and Textiles. Note that regions in neighboring cones produce one good in common.

As cones increase in capital intensity, wages rise and capital rental rates decline. This change in relative factor rewards can be seen by connecting isoquants with their respective isocost lines. Unit value isoquants are tangent to their respective isocost lines under perfect competition. One such isocost line, tangent to Machinery and Textiles, is present in the diagram. Note that the absolute value of the slope of this line indicates the ratio of wages to capital rental rates; since the isocost lines become steeper as countries move from the most labor abundant cone to the most capital abundant cone, relative wages rise.

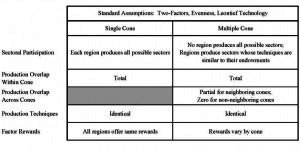

Figure 2 provides a summary of the empirical implications of single and multiple cone equilibria under the basic assumptions outlined in this section. These implications change if the world is uneven, if production requires more than two factor inputs, or if production technologies are not Leontief. We now discuss the implications of each of these complications, in isolation.

Figure 1: Heckscher-Ohlin Specialization

Figure 2: Testing Factor Price Equality — Standard Assumptions