There are often situations in life when a person needs a certain amount of money here and now. There are 3 top ways to solve the problem:

- to ask for money in debt from friends. Let’s just say it’s a bad idea. Even if you have friends who are ready to lend money on a call, do you really want to become a debtor? It will no longer be possible to refuse a response request, which will surely follow soon.

- go to the bank. You can try to take out a cash loan from a bank only if you have a good credit history, have a stable official income and there are no delays on previously issued loans. And if something is wrong? Then you should not even go to the bank, in 90% of cases you will get a refusal.

- contact the payday lending companies. They are much more loyal to their customers. You can take out a small amount of money on fairly favorable terms. How to do it? Let’s try to figure out more about speedy payday loans Texas.

Table of contents

- What are Texas speedy payday loans?

- Texas cash advance rules and regulations

- Applying for speedy loans online in Texas: steps to take

- What can short-term loans be used for?

- Repaying the payday loan TX – how does that work?

- Meeting the requirements for speedy payday loans in Texas

- How soon can I receive Texas payday loans?

- What about bad credit in Texas?

- What benefits will I get when applying for payday loans TX?

- What are the alternatives to payday loans Texas?

What are Texas speedy payday loans?

Texas speedy payday loans are one of the most significant phenomena in the lending market over the past 5-10 years.

Payday loans are considered to be a small loan to an individual, which is issued, as a rule, for a period of up to 30 days in the amount of $1,000.

As you can see, technically, this is very convenient. You receive money within one hour after the request, with a minimum of documents, in any way convenient for you. And if the task is to take out a small loan in the shortest possible time, that loan solves this issue fast, but the rate for this is 1-2% per day.

Texas cash advance rules and regulations

| Texas | |

|---|---|

| Status | Legal |

| Min loan | Not Specified |

| Max loan | $800 |

| Min term | 7 days |

| Max term | 180 days |

| APR | over 400% |

| Rollovers | No Restrictions |

Applying for speedy loans online in Texas: steps to take

Step #1. Select a payday lending service. Check on the official website whether the lending company you have chosen is included in the state register of microfinance organizations.

Step #2. Fill out the application. Before filling in personal data, check the lending website address again and make sure that you are dealing with a legal organization. The leakage of personal data is as dangerous as the loss of the borrower’s documents. Therefore, it is important to know to whom you will transfer your personal data.

Step #3. Enter the required amount and loan term. In the application, specify the amount of the short-term loan that you want to receive on the card.

Step #4. Make sure that the agreement does not include additional services that you do not need. On the online application page, there should be fields next to additional services where you can tick the necessary options. Often these ticks are put down in advance, so if not necessary, do not forget to remove them. If the interface of the lending website does not allow you to take the next step when you refuse additional services, then this is considered a violation.

Step #5. Wait for the text about the application review. Usually, a software makes a decision to issue a loan within an hour. The result will come in a text to the phone number that you specified in the online application. If the application is approved, the confirmation code will be in the text.

Step #6. Enter the confirmation code in a special field on the website. If you are still not sure whether you need a loan, or some terms do not suit you, then by law you have 5 working days to make a final decision. When you enter the code, it will confirm your agreement to sign the agreement. That is, entering a code is equivalent to signing a contract.

Step #7. Track the time of receipt of money on the card. The date of transfer of money to the MFI will be the date of conclusion of the loan agreement. It is from this moment that interest begins to accrue. At the same time, the transfer of money can take from a few minutes to one working day from the moment of signing the contract. If the interest on the loan began to accrue to you before the money came to your card, then this is a violation. You have the right to file a complaint.

What can short-term loans be used for?

Every year the demand for speedy payday loans in Texas (TX) is growing. Online lenders issue thousands of loans remotely every day. Some of these loans are issued for a specific purpose, but the bulk of the contracts are concluded without the purpose of spending funds.

MFI clients prefer to take out short-term loans for the following purposes:

- Credit card bills

- Utility payments

- Rent or mortgage

- School supplies

- Hospital bills

- Prescription costs

- Funeral expenses

- Property taxes

- Moving costs

To meet these goals, it is enough to take out a short-term loan and repay the debt within a month. Speedy payday loans TX can be issued remotely by every citizen if you visit the website of a referral service/lender and fill out an application. Online services are available around the clock.

Some lending services are asked to indicate in the questionnaire the purpose of issuing cash advance. However, this field is rather informational in nature for a credit institution, and filling it out does not affect the decision on the application in any way. No one will check where the payer spent the online quick loan – cash loans from small companies will be called targeted only formally. Conversely, the contract of a bank loan – mortgage, car loan, consumer loan requires compliance with the terms for spending the allocated money.

Repaying the payday loan TX – how does that work?

Paying off a loan is just as convenient as taking it out. Currently, lenders strive to make repayment of the loan as simple and fast as possible for borrowers.

Most services provide many ways to pay off debt:

Using a bank card through a personal account on the company’s website. In this case, you need to specify the details of your card and confirm the debit. With this method, repayment occurs instantly.

A popular way to repay loans is to pay via electronic money. If you do not have a bank card and electronic wallets, it is convenient to pay the debt using money transfer systems.

You can pay for a speedy cash Texas by bank transfer. At the bank branch, you need to provide an ID and payment details. This method is the longest – the transfer can take several days.

Many lending services allow clients to pay the amount of debt through ATMs. In most cases, here you need to specify the name of the microfinance organization, enter the contract number and the date of birth of the borrower. Sometimes you need to specify the payment amount.

If the lending service has offices for customer service, then you can repay the debt in cash by personally visiting such an office. In this case, you need to present the contract and ID.

| Payment option | What you need | Speed | Convenience (5/5) |

| Bank card | Banking details | Instantly | 5 |

| E-wallet | Banking details | Instantly | 4 |

| Payment terminal | Name, contract number, date of birth | Fast | 3 |

| Cash in the office | Contract, ID | Fast | 3 |

| Money transfer | Banking details | Long | 2 |

| Bank transfer | Details, ID | Long | 1 |

Meeting the requirements for speedy payday loans in Texas

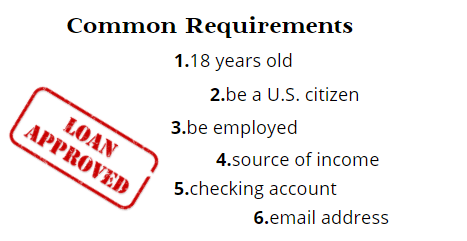

It is possible to meet such loyal requirements to apply for speedy payday loans in Texas. They are:

How soon can I receive Texas payday loans?

Payday loans are considered a quick and effective way to pay for any bills, expenses or emergencies. The ability to receive funds within 1 hour or the same day can be extremely useful – and you have the flexibility to repay in equal monthly installments on a date each month that you choose.

To increase the chances of success, you need to carefully fill out the application avoiding mistakes and inconsistencies that are easy to detect. The more data, the better the situation. This affects the approval, so you should not skip the lines in the application form.

What about bad credit in Texas, TX?

When a client applies to the bank, a positive credit history is one of the main terms for issuing a loan on loyal terms. But what about the others who can’t boast of a perfect credit record?

This service offers a simple and understandable program for correcting credit history. You just need to take out a speedy loan for a minimum term, pay it in a timely manner, and repeat this procedure several times.

As experts explain, in most cases, two or three positive entries in credit bureaus are enough to improve credit score. At the same time, as a financial institution transmits data to the bureau, your personal rating as a borrower increases.

If you need to fix the credit rating quickly, you do not need to apply for large loans. To begin with, apply for a payday loan – for example, to borrow $1,000 for a period of 5 days. It will not be difficult to repay such a bad credit loan, and the credit bureau will receive positive information about the change in financial discipline. It is important to remember that, according to legislation, all financial organizations are required to transmit to the bureau information about customers – positive and negative. Therefore, it is very important to avoid new delays that affect the rating, and to pay the express loan in a timely manner. You can do this online, in your personal account, by card.

What benefits will I get when applying for payday loans TX?

Applying to cash advance services in Texas (TX) has several advantages:

✓high speed of application approval: even a pure credit history or the presence of past delinquencies is not an obstacle for many MFIs;

✓minimum package of documents: only a citizen’s ID is enough, however, if the amount is large or the credit history is damaged, employees may require to provide a certificate confirming income;

✓receiving money in a convenient way for you: cash, transfer to a bank card, etc. popular methods;

✓some MFOs have programs for new clients at a reduced rate;

✓loyalty programs: many lenders take out a loan to regular customers under more favorable terms, for a longer period or at a lower rate;

✓issuing a payday loan online: thanks to Internet service, it is possible to get a loan even on holidays, weekends or at night;

✓the possibility of early repayment and debt restructuring.

What are the alternatives to payday loans Texas?

Installment loans differ from personal loans, credit cards or lines of credit, which typically have more flexible repayment terms and variable interest rates. With installment loans, you always know what to expect when your monthly bill is due.