Sometimes there are situations in which you feel lack in money. Friends and family are not able to help you, because they may be in a similar situation. Banks do not consider you as a potential client due to various reasons.

In this scenario, the only way out may be to apply to speedy payday loans in New Jersey, NJ that are able to provide a loan in 20 minutes from the moment of application submition.

Payday lending companies offer their clients the opportunity to apply for a speedy loan online without providing a large number of certificates. The funds received do not have a purpose, so they can be spent on various needs — tuition fees, shopping, travel.

Table of contents

- What are speedy loans online New Jersey?

- How to get payday loan in New Jersey? (h3-How It Works: Step by Step Checklist)

- Tips on how to issue the loan

- Who can qualify for a speedy payday loan in New Jersey?

- Benefits of accessing payday loans in NJ

- Are there any other short-term options in New Jersey?

- Why am I rejected?

- Reasons to choose bad credit cash advances in NJ

What are speedy loans online New Jersey?

Payday loans New Jersey are a small loan that is issued for a short term without the need to confirm the borrower’s solvency. The distinctive features of speedy cash are the quick decision-making after applying and the absence of the need to provide a large number of documents.

After submitting the application, a potential client receives a response within 5-30 minutes. At the same time, there is a high probability that the lender will approve his candidacy.

Among other features of such a product, there are:

- inappropriate use of funds;

- convenient debt repayment schemes;

- no need to provide collateral;

- quick decision making;

- minimum package of documents.

How to get payday/personal loan in New Jersey?

Large banks very rarely issue small loans to the population, because they are interested in greater amounts. But payday lenders are willing to issue such loans even to those who have previously overdue a loan and have a bad credit score. To receive money, you need to visit the office, provide an ID and fill out an application. After its consideration and approval, the borrower receives money. The procedure usually takes up to 30 minutes.

Those who need money urgently can use online services – they work around the clock. The scheme of loan processing is similar: the application is filled in, ID data, TIN, phone data, bank card, e-mail are specified. The borrower specifies the amount of the loan, the repayment period. The system automatically processes the request and after confirmation and approval of the application, the required amount of money is received on the bank card. As you can see, in order to apply for a loan online, lenders do not require a work certificate and confirmation of official employment from the client.

Keep in mind, New Jearsy officially prohibits payday lending but it is still possible to issue personal loans at small amounts. You are able issue small amount of extra cash at a short term.

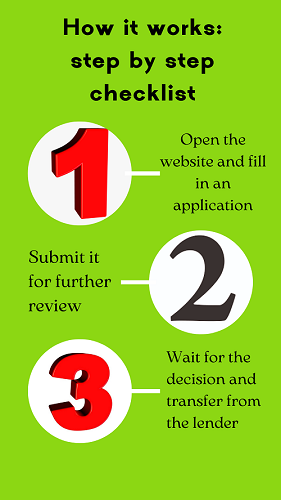

How it works: step by step checklist

Tips on how to issue the loan

Check the details of the organization lending you with the details specified in the state register. Not only the name of the company must match, but also other data.

Check the amount of the full cost of the loan. The terms/rates must be written down at the top on the first page of the loan agreement and shows the actual amount of overpayment under the agreement.

Remember that personal loans in New Jersey are created for urgent lending, therefore, their interest rates are appropriate. If you are considering long-term loans, for a period of more than one year, choose personal loans at any lending facility.

Keep in mind that the lending company cannot demand from you an amount to be paid more than the amount of the loan initially taken out, increased by 1.5 times, even if you are overdue.

Keep all documents, contracts, payment bills (in paper or electronic form) until you receive a certificate from the creditor about the full repayment of the debt.

Who can qualify for a speedy payday loan in NJ?

New Jersey is a state where you can rely on personal loans only. You cannot issue payday loans at lower amounts as it is prohibited by a law. But you may still take out a personal loan in any lending facility. In any case, every person may apply and be approved for speedy cash.

What do you need to borrow funds online?

Any lending company sets its own requirements to qualify for loans, but the most common are:

- be at least 18/21 years old;

- have a US citizenship;

- be employed and have a reliable source of income (sometimes, it should be confirmed by a certificate);

- have a checking account at any US bank;

- have a valid email address and phone number.

Benefits of accessing payday loans in NJ

- High speed of application submission and its reviewing;

- The money is simply deposited to the card after confirmation from a lender;

- There is no need to prove your solvency;

- Don’t need a good credit history;

- Minimum package of documents;

- Favorable and flexible interest rate;

- A fairly long repayment period is 30 days, given that the loan amounts in personal lending companies in New Jersey (NJ) are small;

- Convenience of the service — everything happens online.

Are there any other short-term options in New Jersey?

As New Jersey prohibts speedy payday loans, but there are alternative options such as:

- personal loans are cash borrowed from a bank, credit union or online lender that you pay back in fixed monthly payments, or installments, typically over 2 to 7 years.

- installment loans are a kind of lending product where you can borrow an amount of money at one time. Then you have to pay the loan back over a fixed number of payments, known as installments. Many installment loans also imply fixed payment amounts, meaning the amount doesn’t change over the duration of the loan.

- debt consolidation loans are a personal loan you can use to pay off high-interest debt, typically credit cards. Consolidating debt allows you to use just one loan to pay off one or more credit card balances, which can simplify your repayment plan.

Why am I rejected?

Top reasons why I am rejected for a personal loans in NJ:

✓Mistakes in the application. Invalid data is indicated: deliberately false (of another person or fictitious), outdated (the second name has changed, registration). There may also be a concealment of information and just a typo.

✓Bad credit history. Two years ago, MFIs helped in such a situation, but due to the crisis and the high debt burden of the population, they raised the number of requirements. If there are “bad” debts to any payday lenders, then the debtor is automatically blacklisted.

✓Problems with the police. It is not necessary to have a criminal record, even being under investigation reduces the chances.

✓Excessive debt burden. The number of existing loans makes it risky to issue even a personal loan in New Jersey.

✓Questionable social media profile. When registering and filling out an application, you often need to specify your page in Facebook or Instagram.

✓It takes too much money. Most loans are issued in the lower amount. Large sums are available to regular customers.

✓Problems with bailiffs due to alimony debts, traffic police fines, utilities. Previously, only banks paid attention to them, but now small companies have also taken up the assessment.

✓long time without work that confirms no guaranteed income.

Reasons to choose bad credit cash advances in NJ

However, if you were refused a personal loan, then in order to avoid further problems, you need to find out the reason. Of course, with the help of our referral service, you can always find a lending company and bad credit loans without refusal, but it’s better to find out what’s the matter so that it doesn’t negatively affect other areas of life.

The most common reason for rejections is a bad credit history. In order to check your credit history, you can use the services of any credit bureau. The credit history bureau generates an extract on loans, installments and payment history of a person.

How to clear your credit history?

Therefore, if you know that your credit history is not the best, then the situation needs to be corrected. How can I improve my credit history?

Credit history deteriorates due to delinquency and loan debts. And it is corrected similarly. That is, in order to improve your credit history, you need to take out loans and repay them on time.

It sounds simple, but in fact a borrower with a bad credit history is faced with the fact that not all banks and even online lenders can issue a personal loan in NJ. This is the difficulty of restoring the credit history.